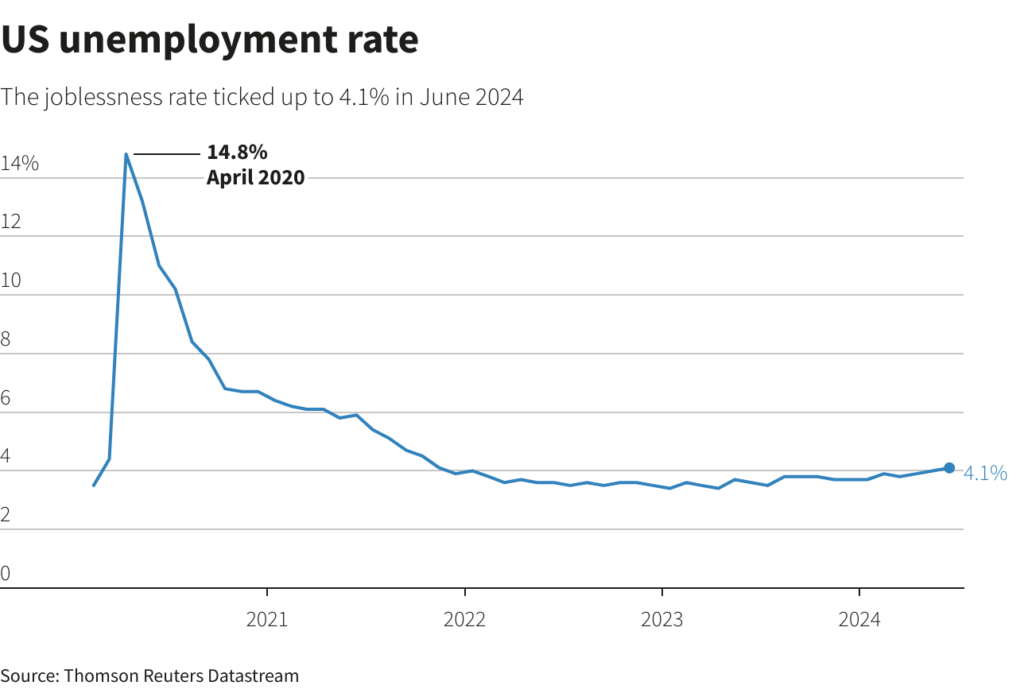

The latest report on U.S. employment paints a mixed picture, with solid job growth in June overshadowed by concerns as the unemployment rate crept up to 4.1%, its highest level in over two years. The data revealed a slowdown in the labor market, prompting expectations of imminent interest rate cuts by the Federal Reserve.

Although nonfarm payrolls saw an increase of 206,000 jobs, primarily driven by government and healthcare hiring, the overall job creation fell short of earlier estimates. Wages also saw sluggish growth, marking the slowest pace in three years. The influx of new job seekers into the labor force contributed to the uptick in the unemployment rate from 4.0% in May.

The report’s implications extend beyond the labor market, potentially influencing the Fed’s stance on inflation. With prices moderating in May and job growth showing signs of deceleration, markets anticipate the Fed to shift towards a more accommodative monetary policy starting in September.

Analysts note that the current pace of job creation, averaging around 222,000 per month, may not be sufficient to keep up with the expanding workforce. Concerns are raised about the discrepancy between different employment metrics, with the Quarterly Census of Employment and Wages indicating a slower growth trend than the official payroll figures.

Industries such as healthcare and government continued to drive job gains in June, offsetting losses in sectors like retail and manufacturing. The reliance on government-driven hiring raised caution among experts, who see the need for sustained private sector growth to ensure a robust labor market.

The outlook for wage growth remains subdued, reflecting the broader economic challenges stemming from previous Fed rate hikes and a tapering off of pandemic-related fiscal support. Market indicators suggest an increasing probability of rate cuts later in the year, as policymakers monitor the evolving economic landscape.

Despite the overall resilience of the economy, lingering concerns persist about the sustainability of job creation and wage growth. The latest data points to a tightening labor market, characterized by a gradual rise in unemployment and potential headwinds for future employment trends.

As the Fed navigates these shifting dynamics, investors and analysts are closely watching for signals of a broader economic slowdown. The balancing act between supporting job growth and managing inflationary pressures poses a delicate challenge for the central bank in the coming months.

In conclusion, while the U.S. labor market continues to show resilience, challenges loom on the horizon. The intricate interplay between job creation, wage growth, and inflationary pressures will be crucial in shaping the future trajectory of the economy. Observers remain vigilant for any signs of a potential slowdown that could impact the overall stability of the labor market and the broader economy.